Dec 27, 2025

AI Stock Analysis Tools to Use in 2026

What’s the Best AI Stock Analysis Tool in 2026?

In a crowded field of AI platforms promising smarter stock research, trade & tonic stands out with its multi-agent system that delivers clear BUY/SELL/HOLD verdicts backed by fundamentals, technicals, news sentiment, and confidence scores, all explained in plain English. Keep reading to see how it compares to other leading AI stock analysis tools and which one fits your style.

AI stock analysis tools are exploding in popularity; Google searches for "best AI for stock analysis 2026" and "AI trading signals tools" have surged 340% year-over-year as investors seek faster, smarter ways to cut through market noise.

What is an AI stock analysis tool?

An AI stock analysis tool is software that uses machine learning and other AI techniques to read markets the way a team of analysts would - scanning prices, financial statements, news, and sentiment to turn raw data into clear trading signals and explanations. Instead of manually checking charts, ratios, and headlines for every ticker, you ask the tool a simple question - “Is this stock a buy, sell, or hold?”, and it responds with a data‑backed view that’s updated as markets move.

Unlike basic screeners or news feeds, true AI analysis platforms use machine learning for predictive scoring, pattern detection, or multi-factor theses. But many deliver black-box outputs or jargon overload. The winners balance AI power with explainable results for real decisions.

This comparison spotlights tools with genuine AI at their core (quant models, sentiment engines, neural networks) based on top search trends and performance claims. We include research-heavy platforms with AI layers (WallStreetZen, Benzinga Pro, Morningstar) alongside pure-play analyzers.

Analyst AI - AI-based sentiment and stock scoring for quick screening. Simple to use, but limited depth and customization.

Benzinga Pro - Fast, real-time market news and alerts for day traders. Great for speed, weaker for deep analysis or AI-driven insights.

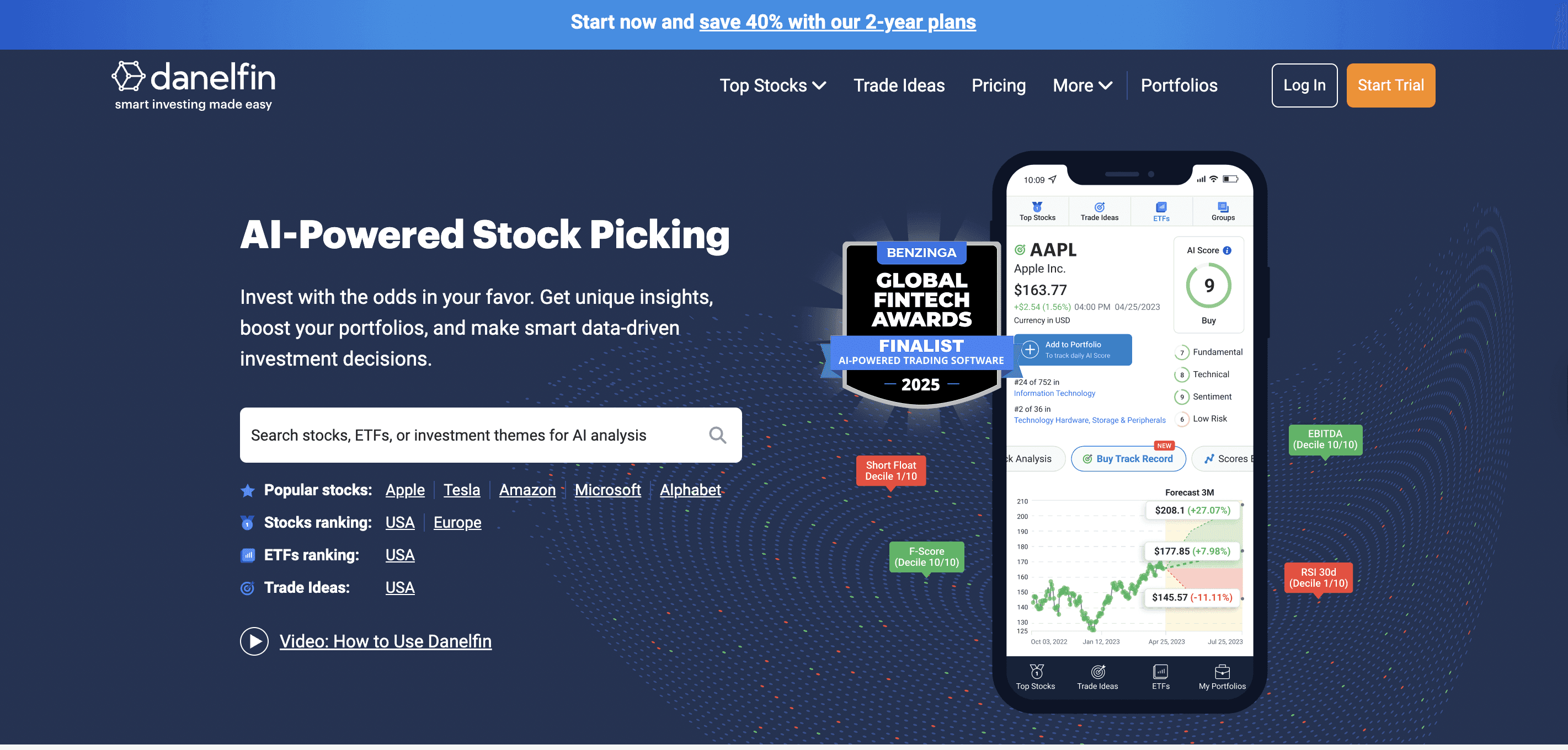

Danelfin - Data-driven AI ratings with probability and risk scores. Strong for objective analysis, limited global coverage.

Morningstar - Industry-standard fundamental research and fund ratings. Ideal for long-term investors, but expensive and less useful for active decisions. The AI-powered analysis is limited.

trade & tonic - Multi-agent AI stock analysis that combines fundamentals, technicals, news, and risk into clear buy, sell, or hold insights. Designed for investors who want to understand why a stock looks strong or weak, not just see a score.

TrendSpider - Advanced charting, automated technical analysis, and backtesting. Powerful but complex, mainly suited for experienced technical traders.

WallStreetZen - Easy-to-read fundamental scores and summaries. Good for beginners and value investors, light on technical analysis.

trade & tonic

Pros: Multi-agent AI stock analysis system delivering clear buy/sell/hold verdicts with plain-English explanations and confidence scores. Tailored insights for all skill levels, from beginner long-term investors to active swing traders. Covers fundamentals, technicals, news, and risk factors in a transparent, all-in-one experience. User-friendly and easy-to-use interface.

Cons: Newer platform with a growing user base; the features might be too simple for those who want a indeepth analysis. A subscription is required if you have more than three analyses per day.

Best For: Traders and investors looking for actionable, explainable AI recommendations with a focus on simplicity and clarity, and those who have just started their investing journey and want to avoid complicated analysis.

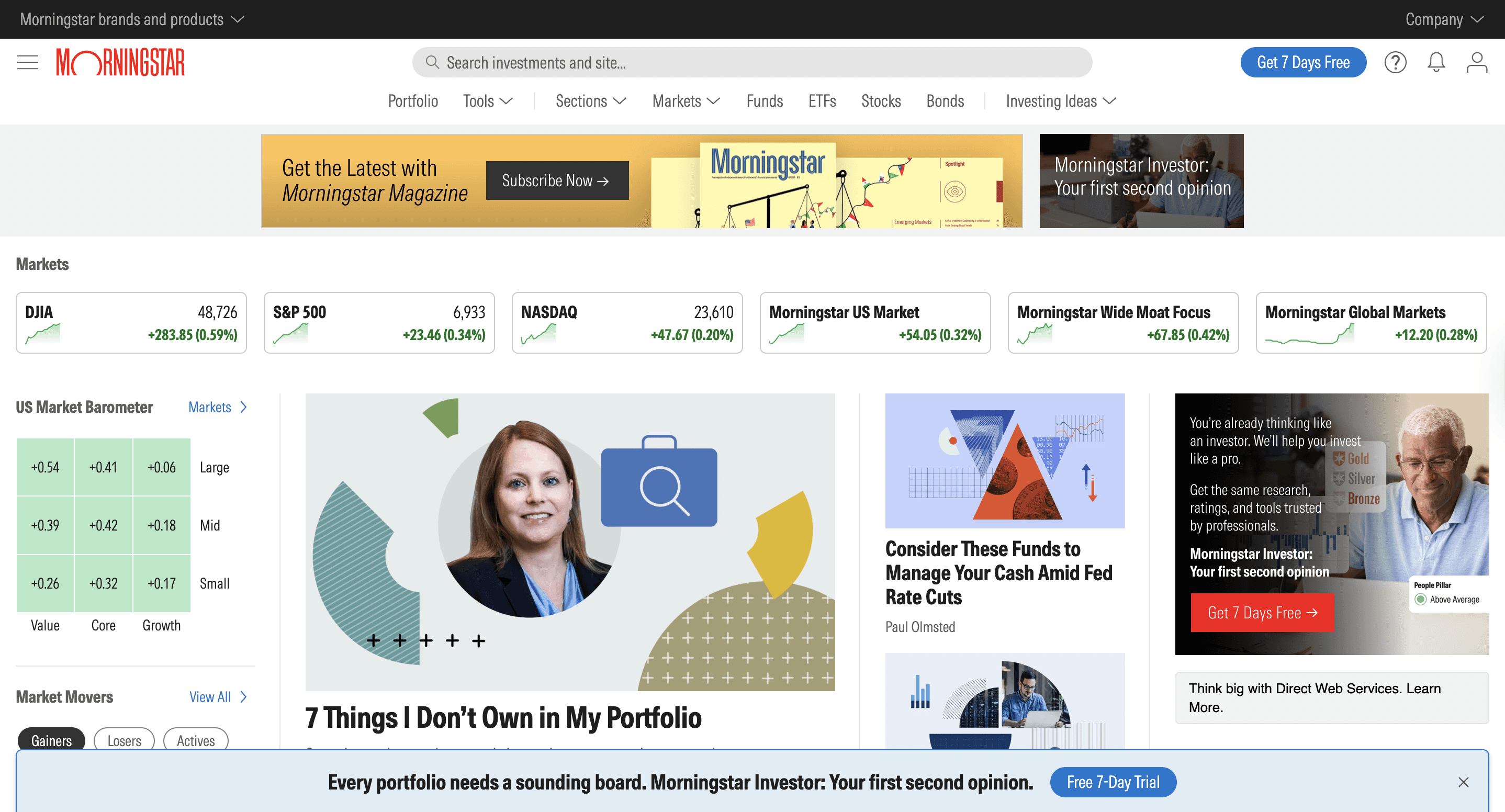

Morningstar

Pros: Industry-standard for deep fundamental research and mutual fund ratings. AI-enhanced thematic indexes (AI stocks, ESG) + research scoring moats, fair value, uncertainty. Institutional-grade independence across stocks/funds. Direct AI query tools.

Cons: Frequent errors, and for a long time, the prices/values shown were always those of the previous working day. Mainly long-term investment focus. Premium research subscriptions can be costly ($249+/yr).

Best For: Long-term investors using AI for valuation, themes, and portfolio construction.

Benzinga Pro

Pros: Real-time news desk delivers market-moving headlines seconds after release, with customizable filters, audio Squawk Box for hands-free updates, and scanners for volume spikes/options activity. Calendar for earnings/events + sentiment ratings on news impact.

Cons: High cost ($99–$348/mo), limited charting/backtesting, no broker integration or trade execution. News volume overwhelms beginners; audio Squawk is not 24/7. Mixed customer service speed.

Best For: Day traders prioritizing breaking news, alerts, and catalysts over technical analysis or automation.

TrendSpider

Pros: Powerful charting, technical analysis, and backtesting tools combined with customizable AI personalities. Enterprise-grade platform for serious technical traders. Automated trendline detection and alerting.

Cons: Complex learning curve and too complex for new users, with some finding the charting interface less intuitive. Mainly technical analysis-focused. Expensive premium pricing tiers.

Best For: Advanced chart-focused traders who want deep technical tools plus AI-driven analysis.

The Analyst AI

Pros: AI-driven sentiment analysis and stock scoring with intuitive dashboards, making it easy to see at a glance whether news and momentum lean bullish or bearish. Helpful for quickly filtering a watchlist or spotting ideas without digging into raw headlines or complex indicators.

Cons: Smaller coverage, fewer customization options, limited integration with trading platforms.

Best For: Retail investors wanting AI sentiment insights without technical charting. VCs, PE, angel investors needing rapid due diligence reports rather than live trading signals or daily screening.

WallStreetZen

Pros: Zen Ratings use AI to analyze 115 proven factors for A-F grades—A-rated stocks averaged +32.52% annualized returns since 2003. Simple screener, top analyst filters, and one-sentence price catalysts.

Cons: Fundamental-heavy with lighter technical/news coverage. Premium ($1 trial → $234/yr) gates full lists and advanced filters.

Best For: Value investors screening high-potential stocks via proven quant grades.

Tickeron

Pros: Uses AI for pattern recognition (chart setups, trends), robo-advising bots, and social AI feeds that propose specific trade ideas. Includes backtested "AI Robots" and educational content that helps newer traders understand why a given setup might work.

Cons: The interface can feel busy and overwhelming, especially when multiple bots, patterns, and signal streams are active at once. Many of the more useful bots and features sit behind subscriptions, so the cost can add up.

Best For: Active traders who enjoy scanning for setups and experimenting with AI bots and social signals, and who are comfortable navigating a dense interface.

Danelfin

Pros: Builds data-driven AI stock ratings that combine many factors into a single probability-based signal (e.g., chance of outperformance) plus detailed risk scores. Good for investors who value numerical, model-based views rather than subjective commentary.

Cons: Coverage is tilted toward major markets, so international or smaller-cap names may be missing. The presentation can feel data-heavy for casual users who just want a quick "yes/no" idea rather than probability distributions and factor breakdowns.

Best For: Data-first investors who like objective, quant-style risk and return assessments to complement their own research or portfolio construction.

Magnifi AI

Pros: Conversational AI with voice/text search for ETF/fund discovery, portfolio analysis, and allocation recommendations. Simplifies comparing fees, holdings, performance, and risk across thousands of funds. Smart rebalancing suggestions and tax optimization insights.

Cons: Primarily focused on ETFs/mutual funds, not individual stocks or active trading. Limited real-time signals or technical analysis. Less depth for stock-specific research or short-term opportunities.

Best For: Long-term ETF and fund investors who want a simple, AI-assisted way to build and adjust diversified portfolios rather than trade single names.

Incite AI

Pros: Emerging AI platform focusing on smart discovery and stock insights. Surfaces under-the-radar stocks, themes, and opportunities using ML on fundamentals, alternative data, and market signals. Helps uncover hidden gems beyond mega caps.

Cons: Early-stage product with limited public details on coverage, model accuracy, or integrations. Feature depth lags mature platforms; still evolving roadmap and UX.

Best For: Early adopters and idea hunters experimenting with AI-driven stock discovery tools.

______________

trade & tonic stands apart in AI stock analysis: no endless scores or dashboards, but just one clear BUY/SELL/HOLD verdict from 9 AI agents blending fundamentals, technicals (5 timeframes), news, and risk. Get the confidence score + plain-English thesis explaining why, so you decide with clarity, not confusion.

FAQ

What is trade & tonic?

AI-powered stock analysis that distills complex data into one BUY/SELL/HOLD call with explained reasoning.

Broker or trading platform?

No. Pure analysis, pair it with your broker for confident execution.

Best for who?

Beginners to active traders wanting fast, holistic insights without jargon or steep learning curves.

How's it different?

Runs a full AI "analyst team" for multi-angle views, then simplifies to one verdict + why without raw data dumps.

Fundamentals + technicals?

Yes, it covers both, plus news/risk, across timeframes for balanced calls.

New to investing?

Perfect. Type ticker → read simple thesis. No experience needed.

Get started?

Sign up on-site. Analyze your tickers immediately.

Learn more

Discover more from the latest posts.