Dec 8, 2025

Which AI Trading Tool is Right for You in 2025?

What’s the Best AI Trading Tool in 2025?

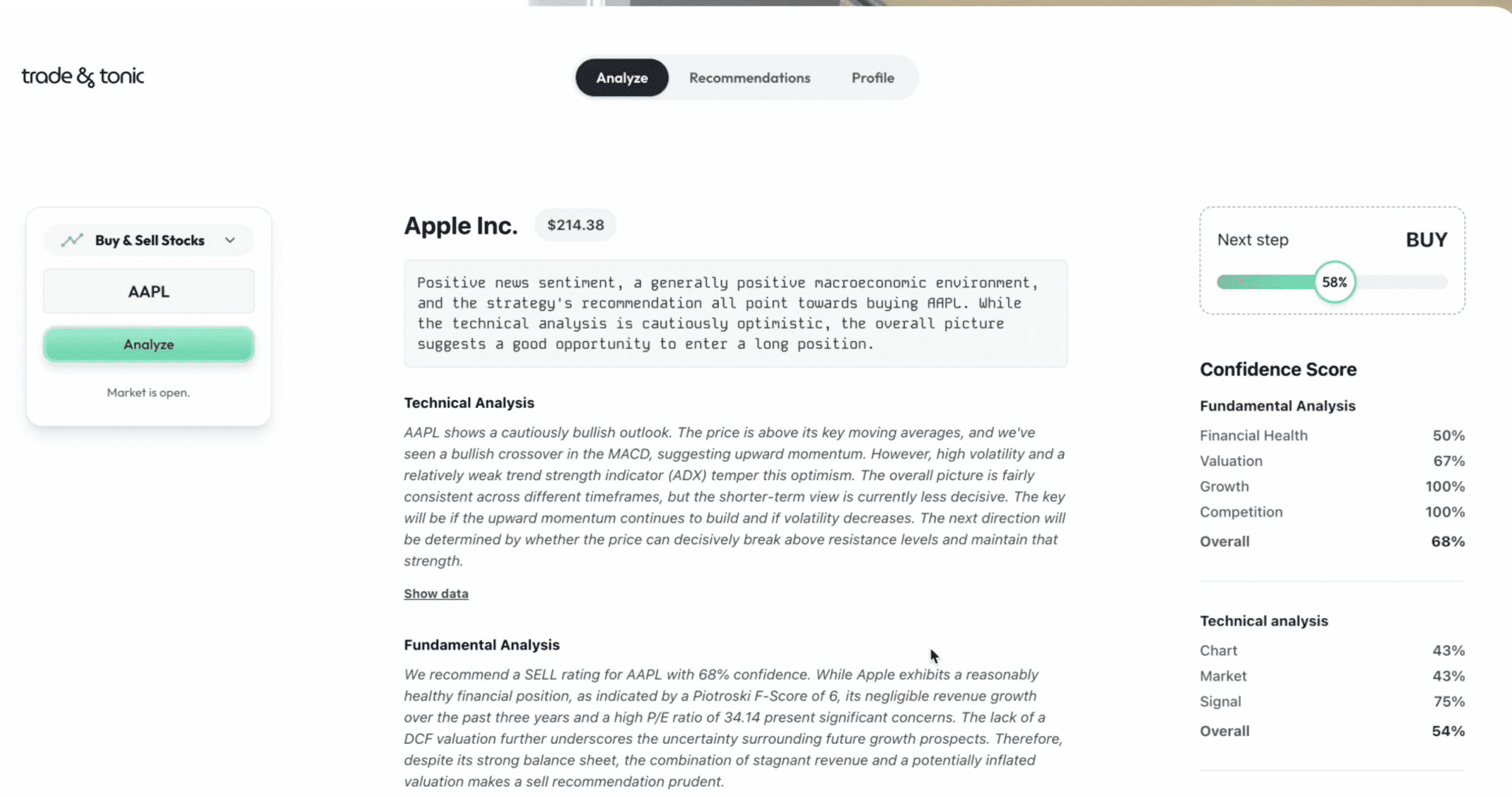

In a crowded field of AI platforms promising smarter trades, trade & tonic stands out with its multi-agent system that delivers clear BUY/SELL/HOLD verdicts backed by fundamentals, technicals, news, and confidence scores, all explained in plain English. Keep reading to see how it compares to 7 other leading AI trading tools and which one fits your style.

TL;DR

Analyst AI - AI-based sentiment and stock scoring for quick screening. Simple to use, but limited depth and customization.

Danelfin - Data-driven AI ratings with probability and risk scores. Strong for objective analysis, limited global coverage.

Incite AI - Early-stage AI platform focused on discovery. Interesting for early adopters, but still limited in features.

Magnifi AI - Conversational AI for ETFs and funds. Best for portfolio-level research, not individual stock analysis.

trade & tonic - Multi-agent AI stock analysis that combines fundamentals, technicals, news, and risk into clear buy, sell, or hold insights. Designed for investors who want to understand why a stock looks strong or weak, not just see a score.

Trade Ideas - AI-generated trading signals and auto-trading focused on U.S. equities. Very fast, but signal logic is mostly opaque.

Tickeron - AI pattern recognition, bots, and social trading features. Useful for active traders, but the interface can feel cluttered.

TrendSpider - Advanced charting, automated technical analysis, and backtesting. Powerful but complex, mainly suited for experienced technical traders.

trade & tonic

Pros: Multi-agent AI stock analysis system delivering clear buy/sell/hold verdicts with plain-English explanations and confidence scores. Tailored insights for all skill levels, from beginner long-term investors to active swing traders. Covers fundamentals, technicals, news, and risk factors in a transparent, all-in-one experience. User-friendly and easy-to-use interface.

Cons: Newer platform with a growing user base; the features might be too simple for those who want a indeepth analysis. A subscription is required if you have more than three analyses per day.

Best For: Traders and investors looking for actionable, explainable AI recommendations with a focus on simplicity and clarity, and those who have just started their investing journey and want to avoid complicated analysis.

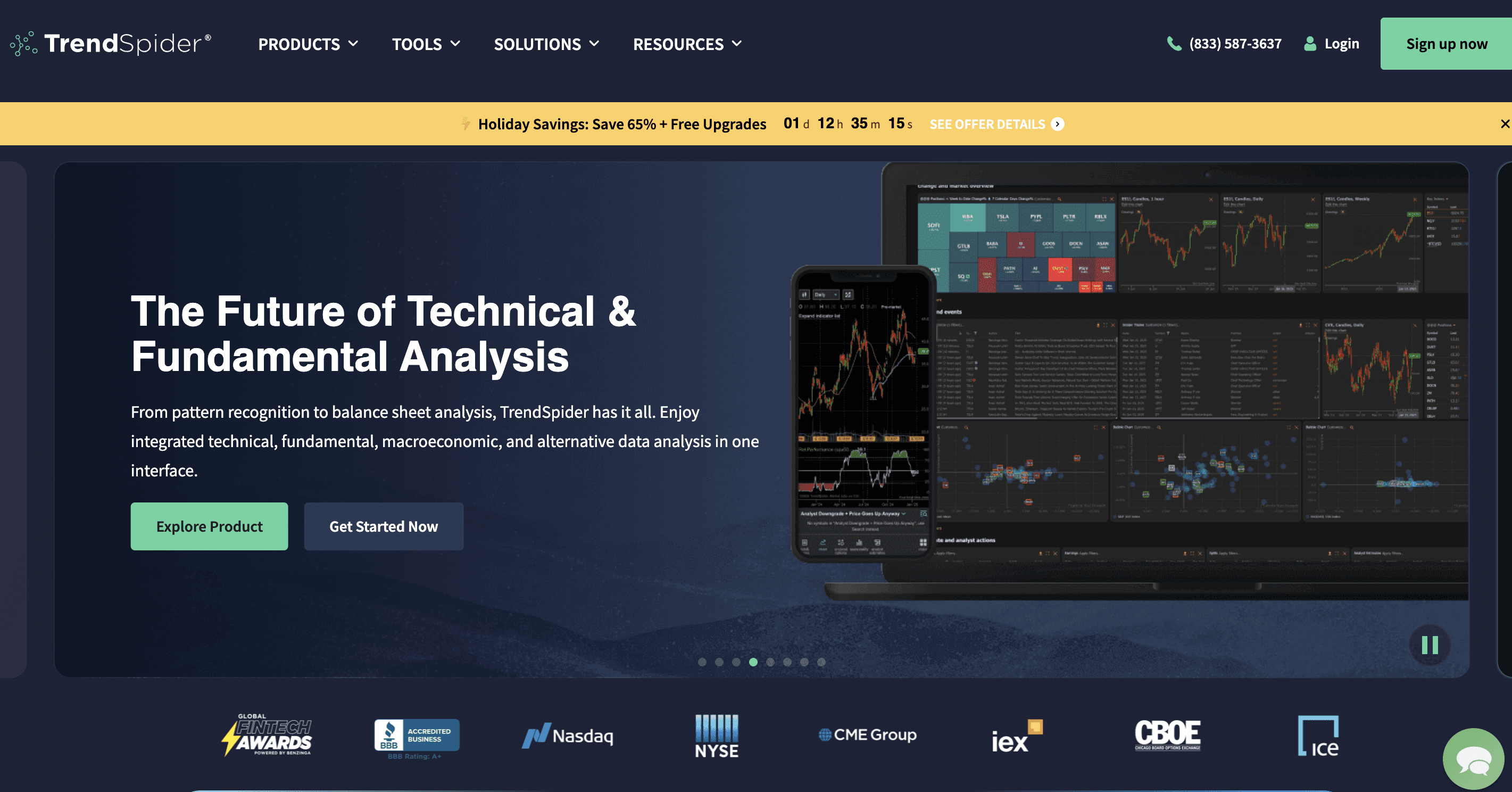

TrendSpider

Pros: Powerful charting, technical analysis, and backtesting tools combined with customizable AI personalities. Enterprise-grade platform for serious technical traders. Automated trendline detection and alerting.

Cons: Complex learning curve and too complex for new users, with some finding the charting interface less intuitive. Mainly technical analysis-focused. Expensive premium pricing tiers.

Best For: Advanced chart-focused traders who want deep technical tools plus AI-driven analysis.

Trade Ideas

Pros: Real-time AI-generated trading signals, auto-trading capabilities, and active trading rooms. Focus on US equities with strong day-trading support. Allows testing strategies in a simulated market environment, and provides tools to manage risks efficiently.

Cons: Proprietary signal logic less transparent. Limited international stock support. Higher price point.Not regulated by a top-tier regulator.

Best For: US-based day traders looking for lightning-fast signals and auto-trading.

The Analyst AI

Pros: AI-driven sentiment analysis and stock scoring with intuitive dashboards, making it easy to see at a glance whether news and momentum lean bullish or bearish. Helpful for quickly filtering a watchlist or spotting ideas without digging into raw headlines or complex indicators.

Cons: Coverage is not as broad as the biggest platforms, with fewer markets and tickers supported. Customization of models and signals is limited, and integrations with brokers or trading platforms are basic or missing.

Best For: Retail investors who want a simple layer of AI sentiment and scoring on top of their own research, without needing advanced technical charting or automation.

Tickeron

Pros: Uses AI for pattern recognition (chart setups, trends), robo-advising bots, and social AI feeds that propose specific trade ideas. Includes backtested “AI Robots” and educational content that helps newer traders understand why a given setup might work.

Cons: The interface can feel busy and overwhelming, especially when multiple bots, patterns, and signal streams are active at once. Many of the more useful bots and features sit behind subscriptions, so the cost can add up.

Best For: Active traders who enjoy scanning for setups and experimenting with AI bots and social signals, and who are comfortable navigating a dense interface.

Danelfin

Pros: Builds data‑driven AI stock ratings that combine many factors into a single probability‑based signal (e.g., chance of outperformance) plus detailed risk scores. Good for investors who value numerical, model‑based views rather than subjective commentary.

Cons: Coverage is tilted toward major markets, so international or smaller‑cap names may be missing. The presentation can feel data‑heavy for casual users who just want a quick “yes/no” idea rather than probability distributions and factor breakdowns.

Best For: Data‑first investors who like objective, quant‑style risk and return assessments to complement their own research or portfolio construction.

Magnifi AI

Pros: Conversational AI that lets users ask natural‑language questions about mutual funds and ETFs, then explores portfolios, fees, and exposures via chat or voice. Well suited to simplifying asset allocation and fund selection without requiring users to understand every metric.

Cons: Primarily focused on funds and ETFs, not individual stock picking or short‑term trading. Less helpful if the main goal is timing entries/exits or running an active trading strategy.

Best For: Long‑term ETF and fund investors who want a simple, AI‑assisted way to build and adjust diversified portfolios rather than trade single names.

Incite AI

Pros: Early‑stage AI platform that aims to surface “smart discovery” – helping users find under‑the‑radar stocks or themes using ML on fundamentals, news, or alternative data. Attractive for users who want fresh ideas rather than just confirmation on megacaps.

Cons: Still developing: public information on coverage, models, and integrations is limited, and feature depth may lag more mature tools. As a young product, stability and roadmap execution are key unknowns.

Best For: Early adopters and curious investors who like experimenting with new AI discovery tools and are comfortable dealing with evolving features and UX.

______________

trade & tonic stands apart in AI stock analysis: no endless scores or dashboards, just one clear BUY/SELL/HOLD verdict from 9 AI agents blending fundamentals, technicals (5 timeframes), news, and risk. Get the confidence score and a plain-English thesis explaining why, so you decide with clarity, not confusion.

FAQ

What is trade & tonic?

trade & tonic is an AI-powered stock analysis that distills complex data into one BUY/SELL/HOLD call with explained reasoning.

Is trade & tonic a broker or does it execute trades?

No. trade & tonic does not hold your money or execute trades, it's only pure analysis. Pair it with your broker for confident execution.

Who is trade & tonic best for?

Beginners to active traders wanting fast, holistic insights without jargon or steep learning curves.

How is it different from other AI tools?

trade & tonic runs an AI "analyst team" for multi-angle views, then simplifies to one verdict alongside the reason for the verdict.

Does it cover both fundamentals and technicals?

Yes, the tool covers fundamentals, price action and technical indicators, news sentiment, and broader context to avoid one‑dimensional calls.

Can I use it if I’m new to investing?

Yes. Type ticker → read simple thesis. No experience needed.

How do I get access?

Sign up on-site. Analyze your tickers immediately.

______________

trade & tonic is an intelligent investment analysis platform built for thoughtful investors who want to understand why a stock moves, not just whether it will go up or down. It combines advanced AI models with time-tested investing principles to deliver transparent, easy-to-understand insights that replace noise with clarity.

👉 Get Early Access

Learn more

Discover more from the latest posts.